Korean Companies Refuse to Share the Wealth

The failure of Korea’s Commercial Act amendment has once again raised concerns about the country's weak shareholder return practices. In response, major institutions are calling for stronger corporate governance and better returns for investors.

Why the Commercial Act Amendment Mattered

In late 2024, Korea’s National Assembly reviewed an amendment to the Commercial Act that proposed:

- Separate election of audit committee members

- Introduction of multi-derivative lawsuits

- Expanded mandatory electronic voting

While these reforms focused on transparency and governance, their broader purpose was to push companies to take shareholders more seriously — potentially leading to increased dividends and stock buybacks.

But the bill failed due to:

- Strong resistance from large corporations, citing concerns over management interference

- Lack of political consensus, stalling progress in parliament

Why Is Korea So Reluctant to Reward Shareholders?

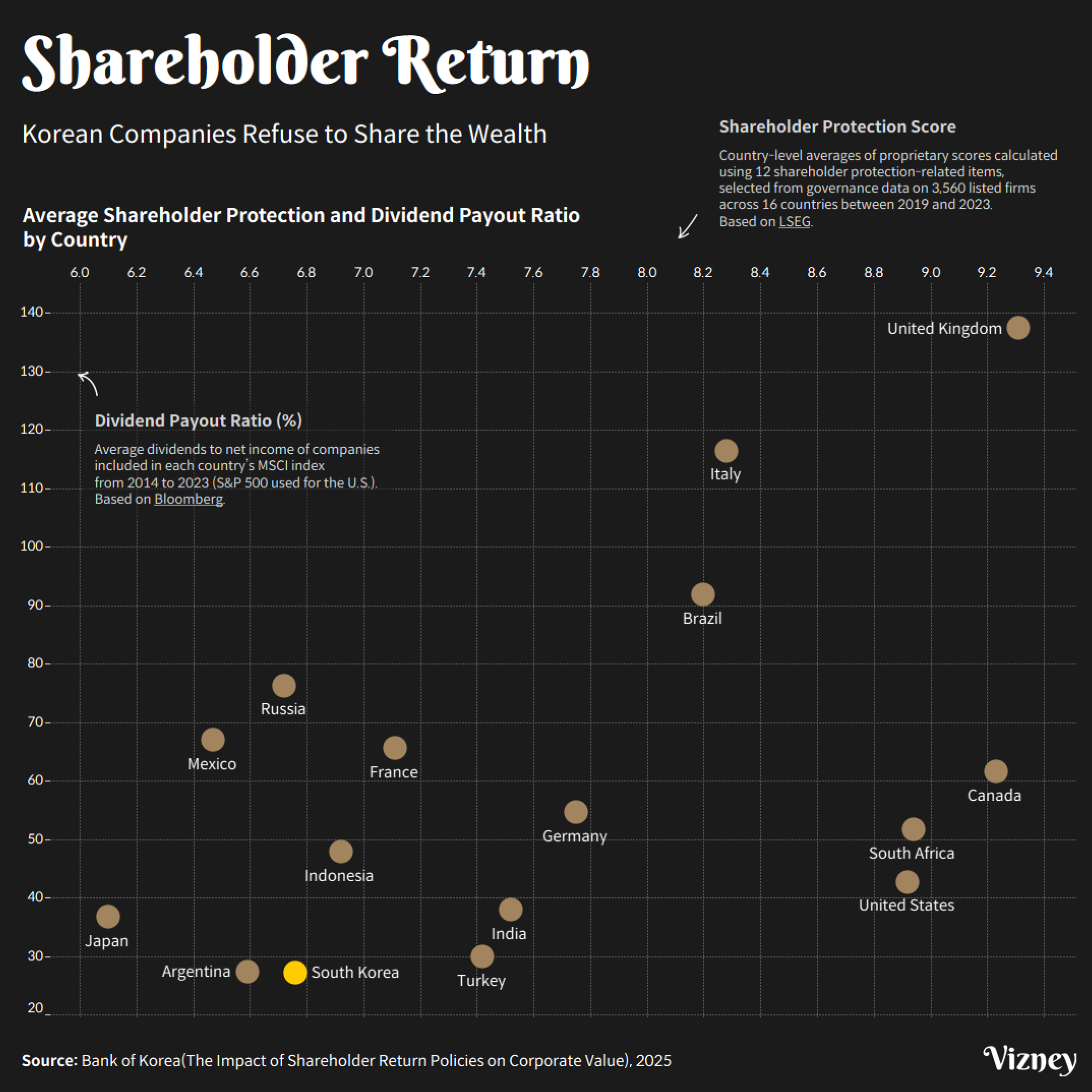

A recent report from the Bank of Korea highlighted how Korean companies return only a fraction of their earnings to shareholders. Just look at the dividend payout ratios:

- United Kingdom: 137.4%

- Italy: 116.4%

- Brazil: 91.8%

- United States: 42.7%

- Japan: 36.7%

- Korea: 27.2%

This reluctance to share profits with investors discourages long-term investment and stifles capital market growth.

The Financial Supervisory Service and the Korea Corporate Governance Forum also stressed that responsible dividend and capital policies are essential for long-term competitiveness.

Shareholder Returns = Competitiveness

The "earn but don’t share" mindset of Korean companies is becoming increasingly unsustainable.

Investors expect more than just performance — they expect real returns. In global markets, dividend payments and buybacks are now standard, not optional.

The failed amendment signals more than a missed reform — it’s a stark reminder of how far Korea’s capital market lags behind global expectations.

It’s time Korean companies and policymakers start treating shareholders not as outsiders, but as key partners in growth.