Korea’s Elderly Poverty: A Call for Policy Rethink

South Korea, facing the highest old-age poverty rate in the OECD, is considering extending the retirement age. Drawing on past experience and Japan’s gradual reforms, a careful approach is needed—one that includes wage system changes and flexible reemployment policies.

South Korea is quickly entering a super-aged society. As of the end of 2024, the proportion of the population aged 65 and older has reached 20%. This figure is expected to rise to 30% by 2035 and exceed 40% by 2050. These demographic shifts have far-reaching implications for society, particularly in terms of income security for the elderly and the structure of the labor market.

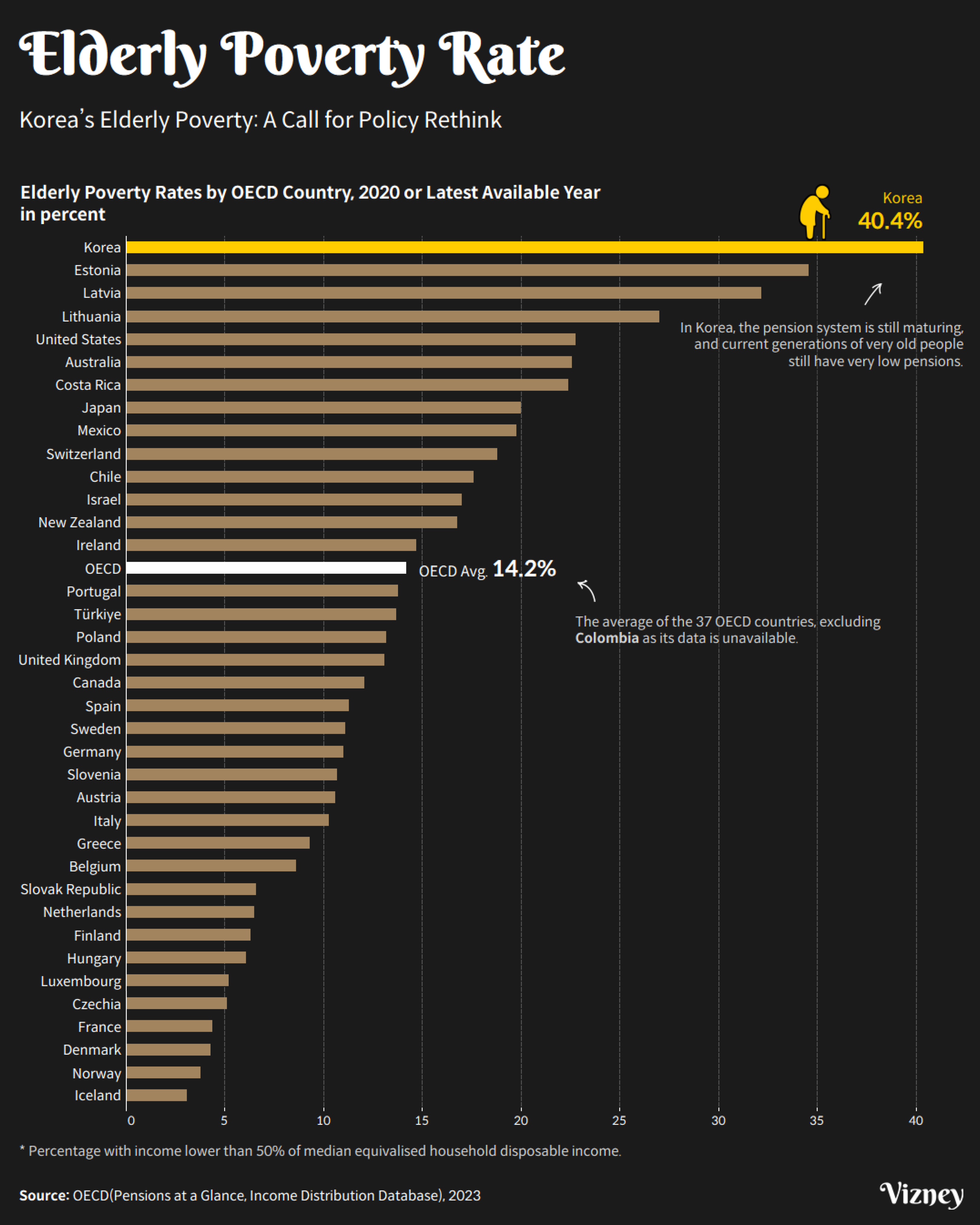

According to statistics, South Korea’s elderly poverty rate is the highest among OECD member countries. The 2023 OECD report shows that Korea’s elderly poverty rate stands at 40.4%, nearly three times the OECD average of 14.2%. This highlights the urgent need to address elderly income security, welfare, and continued participation in economic activity.

The Case for Extending the Retirement Age—and Associated Challenges

Older adults in Korea demonstrate a strong willingness to continue working. Among those aged 55 to 79, over 70% say they wish to remain employed, and over 90% of elderly workers say the same. This desire stems not only from financial necessity but also from the value of social engagement and self-fulfillment.

Currently, the statutory retirement age is 60, while the national pension eligibility age is gradually increasing to 65. As a result, retirees face a five-year income gap between leaving the workforce and receiving pension benefits, exacerbating the risk of elderly poverty.

To address these challenges, the government is discussing retirement age extension. However, such a change could have wide-ranging effects on the labor market in the short term, requiring careful and deliberate consideration.

Lessons from Korea’s 2016 Retirement Age Extension

South Korea already extended the legal retirement age to 60 in 2016. However, this policy was implemented without accompanying reforms to the wage system or employment structure. While it did lead to increased employment among older workers, the benefits were largely concentrated in large firms and unionized workplaces. Many businesses responded by increasing early retirement incentives to offset labor costs.

Empirical analyses also suggest that for every additional older worker employed, the number of younger workers decreased by about 0.4 to 1.5. This indicates that younger jobseekers, particularly in firms with limited flexibility, may have been indirectly affected.

These findings suggest that without broader labor market reforms—such as adjusting the wage structure or offering flexible working arrangements—raising the retirement age alone may not yield the desired outcomes.

Insights from Japan’s Experience

Japan entered a super-aged society before Korea and has adopted a phased approach to addressing aging workforce challenges. Over the past 30 years, Japan has implemented a roadmap that includes a 60-year retirement age, a 65-year employment guarantee, and policies to support employment opportunities up to age 70.

The 65-year employment guarantee began as a “voluntary obligation” and gradually transitioned into a legal requirement. Japan also implemented wage system reforms and introduced flexible work arrangements in tandem with these changes.

Furthermore, Japan allows companies and workers to choose from various post-retirement employment options, including reemployment after retirement, elimination of mandatory retirement, freelance contracts, entrepreneurship support, and more.

Japan’s experience illustrates that raising the retirement age is not a one-size-fits-all solution. A gradual, multi-faceted strategy tailored to the country’s labor market conditions and legal system is essential.

Looking Ahead

As aging progresses rapidly, expanding the economic participation of older adults is essential to maintaining national competitiveness and improving individual quality of life. However, this cannot be achieved through retirement age extension alone. The following aspects must be considered:

- Flexible wage structures: Shift from seniority-based to performance- or task-based pay

- Diverse working arrangements: Allow flexibility in working hours and job roles

- Step-by-step expansion of reemployment systems: Encourage voluntary adoption, followed by gradual mandatory implementation

It is important to design policies that enhance the quality of life for older workers while maintaining generational balance in the labor market. With thoughtful reform, Korea can build a sustainable labor structure even as it transitions further into a super-aged society.